Ifra Siddiqui

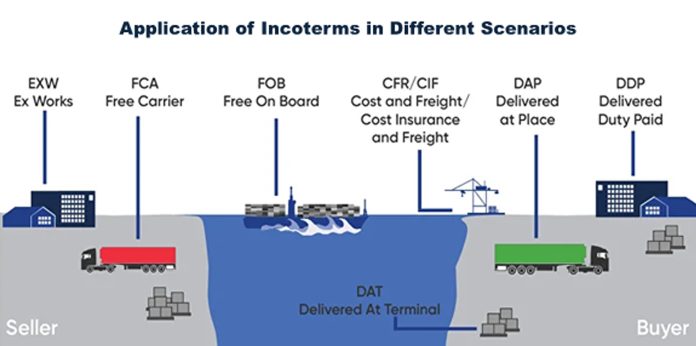

International Commercial Terms or Incoterms are a set of rules created by the International Chamber of Commerce (ICC) in 1936 that make international trade comparatively easier and clearer. These terms specify the responsibilities of each party when goods are shipped internationally, including who covers the costs of transportation, insurance, and customs duties, as well as clearly defining when the responsibility for goods transfers from the seller to the buyer.

The universal recognition of these terms facilitates the prevention of conflicts and misunderstandings among international trade partners. Hence, Incoterms, by providing a common language for trade, support smoother transactions, reduce risks, and contribute to strengthen economic relationships among nations.

The first version of Incoterms was introduced in 1936, with subsequent updates in 1967 and 1980 to reflect changes in trade practices and transportation technology. Each update aimed to address evolving needs, such as containerization and the growth of global trade, leading to significant revisions. The 1990 update focused on using clearer terms and better defining responsibilities to align with the new trading environment.

In 2000, Incoterms were further simplified and reorganized for greater clarity and ease of use. The 2010 update refined the terms to better match modern shipping practices. The 2020 revision introduced new terms and updated existing ones to address emerging challenges, such as changes in transportation methods and the growing role of digital technology.

For better exploration here the most used terms are briefly elaborated which have been introduced or redefined in the 2020 update: the term DPU (Delivered at Place Unloaded) replaced DAT (Delivered at Terminal) to cover a broader range of unloading situations. The term Free Carrier (FCA) specifies that the seller delivers the goods to a carrier or another person nominated by the buyer at a named place, covering all costs and risks up to that point.

FAS (Free Alongside Ship) means the seller places the goods next to the ship at the port chosen by the buyer, after which the buyer assumes all risks and costs. FOB (Free on Board) requires the seller to load the goods onto the buyer’s ship at the port of shipment, transferring both risk and costs to the buyer once the goods are on board. CFR (Cost and Freight) involves the seller paying for shipping to the destination port, but the risk transfers to the buyer once the goods are on board the ship.

CPT (Carriage Paid To) means the seller covers the cost of transporting the goods to a specified destination, with the risk passing to the buyer once the goods are handed over to the carrier. EXW (Ex Works) means the seller keeps the goods ready at their place (like a factory or warehouse). The buyer is responsible for all the costs and risks of moving the goods from the seller’s place to where they want them. CIP (Carriage and Insurance Paid To) is Similar to CPT, but the seller also arranges and pays for insurance to cover the buyer’s risk during the transport. DDP (Delivered Duty Paid) means the seller is responsible for delivering the goods to the named place in the buyer’s country and pays all costs, including duties, taxes, and customs clearance.

These terms indicate that the entire process is thoroughly structured, with clear delineation of responsibilities for various aspects of the shipping procedures. While examining the influence of Incoterms within the context of the global supply chain, it becomes evident that these standardized rules have profoundly impacted international trade by streamlining the movement of goods across borders. To illustrate this significance, we can look at the trade relationships between the United States and China, as well as Germany and India, as case studies.

The trade relationship between the US and China has undergone substantial changes over the years. As China has emerged as a global economic powerhouse, trade policies between the two nations have also evolved. Key stakeholders in this relationship include US government entities like the United States Trade Representative (USTR) and Chinese organizations such as the Ministry of Commerce, in addition to major corporations from both countries.

China’s accession to the World Trade Organization (WTO) in 2001 was a pivotal moment that altered global trade dynamics. Bilateral agreements, such as the Phase One Trade Deal signed in January 2020, have played a crucial role in shaping trade interactions by facilitating the resolution of specific issues and strengthening economic ties. Often, one nation experiences a trade surplus (exporting more than it imports), while the other faces a trade deficit, influencing various sectors like technology, agriculture, and manufacturing.

Political factors also play a critical role in the US-China trade relationship. Trade wars and tariffs can disrupt global supply chains and hinder economic growth. Additionally, competition over issues such as national security and technological dominance further complicates trade relations. Examining specific companies, like Huawei and Apple, reveals how these trade dynamics affect different industries. Moving forward, the outcome of ongoing trade negotiations and economic forecasts will be key to the future development of this relationship. Policymakers must navigate these challenges with care to mitigate potential risks.

In the case study examining German-Indian trade relations, the German company Müller Maschinenbau agreed to export a large industrial press to Bharat Auto Components, located in Pune, India. Both parties decided to utilize the DAP (Delivered at Place) Incoterm for this transaction, assigning Müller Maschinenbau the responsibility for transporting the machinery directly to Bharat Auto’s facility. This included organizing the shipping process, managing customs clearance procedures in Germany, and covering all associated transportation expenses.

Conversely, Bharat Auto was tasked with handling the customs clearance upon the equipment’s arrival in India and overseeing its unloading at their site. Recognizing the significant value of the industrial press, Müller Maschinenbau opted to ensure the shipment despite insurance not being a requirement under the DAP terms. The delivery was completed successfully, overcoming minor challenges such as potential customs delays, and both companies expressed satisfaction with the outcome. The application of the DAP Incoterm provided a well-defined framework that facilitated the smooth coordination of logistics and responsibilities throughout the transaction.

Looking ahead, as the landscape of international trade evolves, Incoterms are expected to adapt, incorporating digital tools and addressing emerging trends like environmental sustainability. New terms may be introduced, and existing ones clarified to meet modern requirements, although challenges such as differing international practices and ambiguous rules may persist. Overall, Incoterms will continue to evolve in response to the changing dynamics of global trade.

The author is a Research Intern at Rabita Forum International (RFI).